About Reliance Standard Life

-

With over $30 billion in Assets Under Management (AUM)1 and superior financial strength ratings, we are a strong, stable financial institution.

-

As an integrated member of one of the world’s largest and most respected global insurance groups, the Tokio Marine Group, we have excess capital to pursue disciplined growth.

-

Our business is built on the promise of providing savers with safe, secure annuities to help them preserve wealth into retirement and beyond. Annuities help protect retirement savings from market volatility and provide financial peace of mind

-

Fixed index annuities offer indexed interest strategies that can generate market-linked returns while eliminating market losses.

-

Our traditional fixed rate alternatives provide a stated fixed annual rate of interest for certainty

-

Our integrated staffing, training and technology helps ensure every external touchpoint is efficient, accurate and seamless — resulting in a highly consistent and thoughtful service experience.

-

Our sustained, organic investment growth is a testament to our superior investment management competency and ability to create value.

-

Our solid reputation and sound risk management framework have allowed our investment management responsibilities to span the globe, as the trusted asset manager for Tokio Marine and its affiliates.

-

1 Statutory Assets 9/30/25.

Reliance Standard Life Timeline

1907 – Central Standard Life Insurance Company is founded in Chicago, Illinois, establishing the foundation of our long-standing legacy.

1963 – Through the acquisition by Reliance Insurance, Reliance Standard Life Insurance Company is formed, marking a pivotal moment in the organization’s evolution.

1987 – Rosenkranz & Company acquires Reliance Insurance, forming Delphi Financial Group and strengthening the company’s position for long-term growth.

2012 - Delphi Financial Group joins Tokio Marine Holdings, Inc., becoming part of the Tokio Marine Group—one of the world’s largest multinational insurance organizations—and reinforcing our ability to meet long-term commitments.

2021 - Received a superior financial strength rating from AM Best (A++), together with strong ratings from S&P (A+), Moody’s (A1), demonstrating our long-term financial strength and reliability.

2025 – Recognized as a Best Place to Work for Women and one of America’s Best Workplaces, because the people who serve our clients deserve an exceptional workplace.

About Tokio Marine

Reliance Standard is a member of the Tokio Marine Group. Tokio Marine Holdings, Inc., the ultimate holding company of the Tokio Marine Group, is incorporated in Japan and is listed on the Tokyo Stock Exchange. The Tokio Marine Group operates in the property and casualty insurance, reinsurance and life insurance sectors globally. The Group’s main operating subsidiary, Tokio Marine & Nichido Fire (TMNF), was founded in 1879 and is the oldest and leading property and casualty insurer in Japan.

The Tokio Marine Group provides support, strength, and stability to customers and our society in a world filled with risk. We give individuals, businesses and partners the confidence to explore new possibilities and take next steps. We are committed to building more resilient economies, industries, and societies in a rapidly changing world.

With over 140 years of experience and expertise spread across a global network – supported by technology and empowered by a corporate culture dedicated to doing the right thing – we harness the power of confidence for our customers and society.

Financial Highlights

Strength You Can Depend On

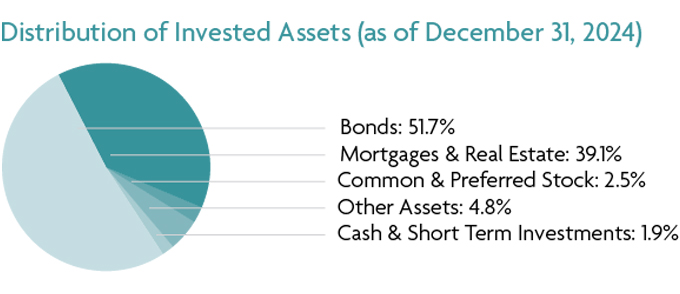

Diversified Investment Portfolio

While ratings are an important measure of financial strength and stability, it is also essential to review the quality, allocation and diversification of an insurance company’s investment portfolio.

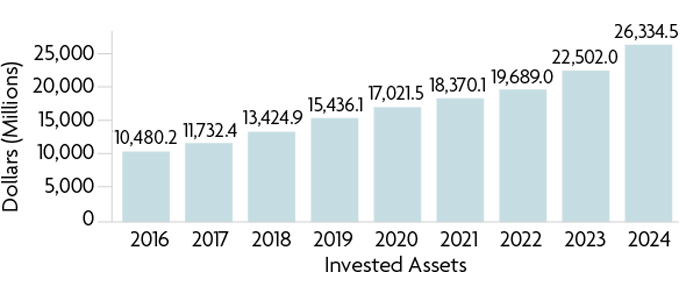

Growth of Invested Assets

Sustained asset growth demonstrates an insurance company’s strength and stability. Reliance Standard has maintained a strong balance sheet through a measured and conservative approach to managing our assets.

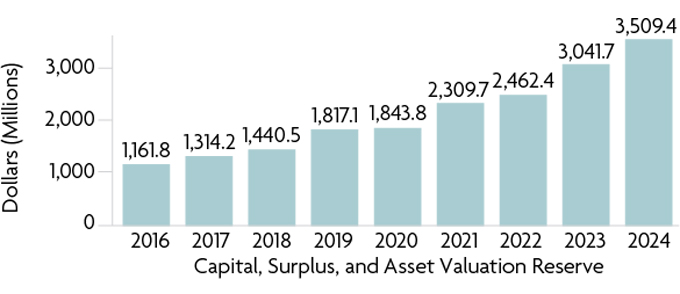

Capital, Surplus, and Asset Valuation Reserve

Capital and surplus growth provides further cushions against unexpected events, representing our financial strength and continuing commitment to our policy-holders.

Sound Ratings

Financial Strength Ratings are independent opinions regarding the creditworthiness of an insurer and are based on a comprehensive quantitative and qualitative evaluation of a company’s balance sheet strength, operating performance and business profile. They are not a recommendation to purchase or an evaluation of a specific insurance or annuity product. Ratings are current as of December 2025.

AM Best: “A++” (Superior) since 11/17/21

- Highest of 15 rating levels

- Rating affirmed 11/19/25

Standard & Poor’s: “A+” (Strong) since 9/24/21

- 5th highest of 21 rating levels

- Rating affirmed 12/11/25

Moody’s: “A1” (Strong) since 1/31/23

- 5th highest of 21 rating levels

- Upgraded January 2023

- Rating affirmed 2/12/25

*Ratings shown reflect the opinions of each nationally recognized independent rating agency and are not implied warranties of the company’s ability to meet its financial obligations. All ratings are subject to revision or withdrawal at any time by the rating agencies, and therefore, no assurance can be given that these ratings will be maintained.

Download Ratings and Financial Information

Annual Statement (For the Year Ended December 31, 2024)

Quarterly Statement

Reliance Standard (2025 Q3)

Fixed Income Investor Update (June 30, 2025)

Audited Financial Statements – Statutory Basis (For the Periods Ending December 31, 2024, 2023 and 2022)

We Look Beyond Profit to help build strong communities

Reliance/Delphi Project Foundation

Since 1996, tens of thousands of Philadelphia teens have benefited from Reliance Standard’s outreach programs through the generous funding of our foundation (formerly the Delphi Project Foundation). These programs introduce arts experiences to empower underserved Philadelphia-area public school students. Now operating as the Reliance Matrix foundation, the foundation provides the space for creative freedom and expression through art, dance, filmmaking and more. The programs positively impact students by building their self-esteem, enhancing their critical thinking skills, exposing them to career opportunities and providing them with a safe and enriching environment.

Charity Partners

Giving back to our communities is a top priority at Reliance Matrix. We support a nation-wide charity partner every year; past partners include Make A Wish Foundation, St. Jude Children’s Hospital, and Feeding America. Every two years, team members help select a new partner by voting based on company criteria. In the last three years, our team members have donated almost $120,000 to various partners.

Good Company Committee

The Good Company Committee is an enterprise-wide initiative created to support and promote the guiding principles of Tokio Marine: Look Beyond Profit, Deliver On Commitments, and Empower Our People. Powered by team members from around the enterprise, our committee plans, promotes and implements activities and communications on behalf of colleagues and charity partners. The committee encourages volunteerism and helping build stronger communities.

Building an Inclusive Culture

At Reliance Standard, we believe:

- Creating an inclusive culture that values difference and prioritizes opportunities for all allows us to realize more of our potential and gives us a competitive advantage.

- Our ability to collaborate, solve complex problems, and innovate into the future is stronger when we can leverage the collective intelligence of all our team members.

We want everyone to have an opportunity to fully participate and contribute. Our team members feel their opinions are relevant and what they have to say is heard. We create an environment that allows us to tap into individual experiences, opinions, and worldviews. Doing so gives us more understanding and connectivity to the customers we serve.

Home

Home